Buy Now, Pay Later (BNPL) services, like Katapult, offer a convenient way to finance purchases. But with a multitude of options available, choosing the right app can be challenging. This comprehensive guide provides a detailed comparison of different BNPL apps, highlighting their strengths and weaknesses to help you make informed financial decisions.

Understanding the BNPL Landscape: Short-Term vs. Long-Term Options

The BNPL market offers a diverse range of services. Some apps, like Affirm and Klarna, focus on short-term, interest-free payment plans suitable for smaller purchases. Others, such as Katapult, specialize in longer-term financing for larger items, often involving lease-to-own arrangements. The ideal choice depends entirely on your specific needs and financial situation. Are you buying a new pair of shoes or a new refrigerator? This significantly impacts your choice of BNPL app.

Key Differences Between Short-Term and Long-Term BNPL Apps

The fundamental difference lies in the repayment period and the types of purchases they typically finance.

| Feature | Short-Term BNPL (e.g., Affirm, Klarna) | Long-Term BNPL (Apps like Katapult) |

|---|---|---|

| Payment Plans | Typically 4-6 payments | Often 6-18+ months |

| Purchase Amounts | Smaller purchases (e.g., clothing, electronics) | Larger purchases (e.g., furniture, appliances) |

| Interest Rates | Often 0% interest (if paid on time) | Interest may apply, influencing the total cost |

| Credit Impact | Usually minimal immediate credit score impact, but late payments can harm your credit. | Can impact your credit report; responsible use can build credit, while irresponsible use can negatively affect it. |

Finding the Best BNPL App: A Step-by-Step Guide

Choosing the right BNPL app requires careful planning. Follow these five essential steps:

Assess Your Needs: Determine the purchase amount, your desired repayment period, and your comfort level with regular payments. Honesty about your budget is crucial.

Compare BNPL Providers: Research several apps, focusing on interest rates (if applicable), fees, and repayment terms. Prioritize clear and transparent providers.

Review Customer Feedback: Explore user reviews on platforms like Trustpilot or app stores to gain insights into real-world experiences. Look for recurring themes in the feedback. Is there consistent praise or persistent complaint regarding late payment handling?

Scrutinize the Fine Print: Meticulously review the terms and conditions before signing up. Pay close attention to late payment penalties and procedures for handling financial difficulties.

Prioritize Responsible Use: Budget meticulously to ensure you can afford the monthly payments comfortably. Remember, late payments negatively impact your credit score regardless of the app.

The Advantages and Disadvantages of BNPL Services

BNPL services offer significant advantages, but potential downsides need careful consideration.

Pros:

- Convenience: Quick and straightforward application processes.

- Flexibility: Distributes payments over time, simplifying budgeting for some.

- Purchase Access: Allows purchasing items that may not be immediately affordable otherwise.

Cons:

- Overspending Risk: The ease of payment can lead to overspending.

- Debt Accumulation Potential: Missed payments can result in accumulating fees and debt.

- Credit Score Impact: Late payments can negatively impact your credit score.

Navigating the Evolving Regulatory Landscape of BNPL

The regulatory environment governing BNPL is dynamic. Governments worldwide monitor these services closely, emphasizing consumer protection and responsible lending practices. Staying informed about regulatory updates is crucial, as these changes can affect the services offered by apps like Katapult and its competitors.

How to Compare BNPL Services Based on Your Credit Score

Your credit score significantly impacts your eligibility and the terms offered by BNPL providers.

"The BNPL market is becoming increasingly competitive," says Dr. Anya Sharma, Professor of Finance at the University of California, Berkeley. "Consumers should actively compare features and fees to avoid potentially high interest and fees."

Define Your Needs: Clarify the purchase amount, required financing, and preferred repayment timeline.

Check Credit Eligibility: Pre-qualify with multiple providers to understand your options before committing to lengthy applications.

Compare Fees and Interest Rates: Scrutinize the fee structure of each provider, including late payment penalties, missed payment fees, and interest rates (where applicable). Pay special attention to how creditworthiness impacts these costs.

Assess Repayment Terms: Consider the repayment duration, payment options, and whether early repayment charges exist.

Thoroughly Read Terms and Conditions: Don’t overlook reading the fine print of each agreement before committing to a provider.

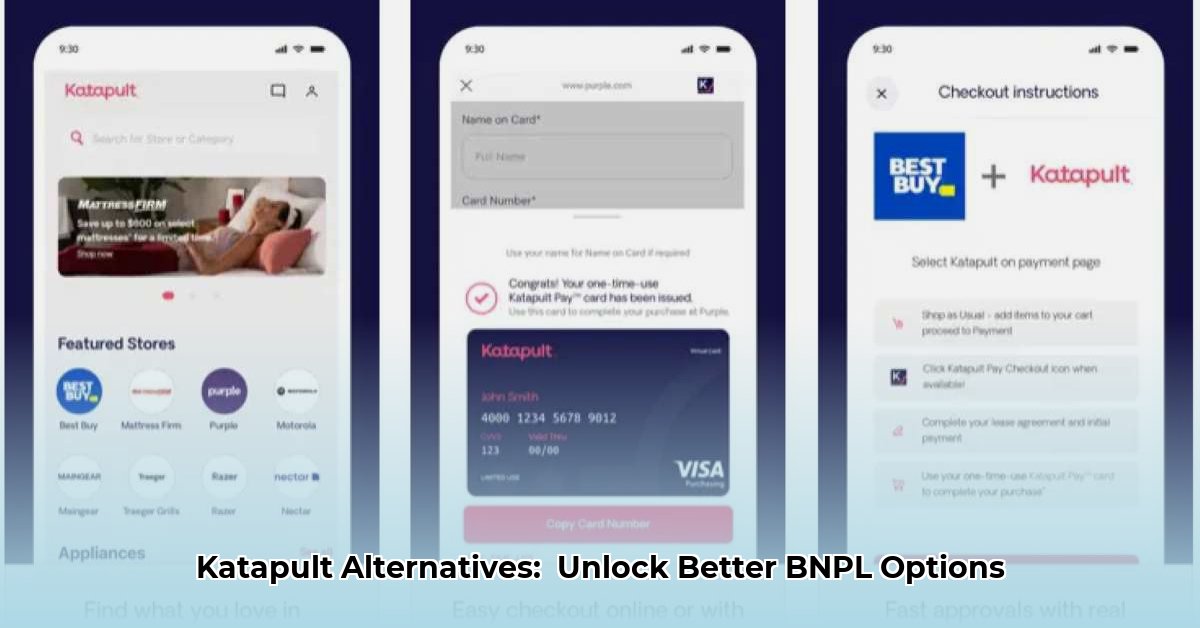

A Case Study: Katapult and its Competitors

Katapult typically offers longer-term payment plans compared to other providers. While this extended repayment period provides flexibility, it’s essential to compare the associated interest charges with competitors. Consumers should consider whether the added flexibility outweighs potentially higher costs, especially given the impact of credit score on the offered terms.

Key Takeaways: Choosing the Right BNPL App

The BNPL market offers many choices, each with different strengths and weaknesses. Careful research and responsible usage are paramount. By understanding the nuances of short-term versus long-term options, comparing providers, and adhering to responsible borrowing practices, consumers can leverage BNPL services effectively and avoid potential pitfalls. Remember that seeking advice from a financial advisor ensures clarity on financial decisions related to BNPL services.